Recently, the International Federation of Robotics (IFR) released the market statistics of the "World Robotics report 2019". The data shows that the annual sales of industrial robots in the world reached USD 16.5 billion in 2018. A new record was set, with over 400,000 units installed for the first time, an increase of 6% over the previous year.

At present, Asia is the world's largest industrial robot market. But in 2018, the situation in the three major markets in Asia changed: Among them, the installation volume of China and South Korea declined, and Japan increased significantly. The overall growth rate in Asia is 1%.

As the second largest market in Europe, robot installations increased by 14%, reaching a new peak for the sixth consecutive year.

In the Americas, the growth rate has increased by 20% over the previous year, and it has also set a new record for six consecutive years.

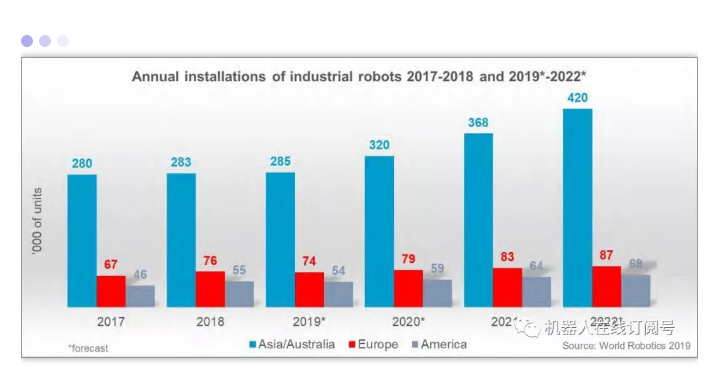

IFR forecasts that industrial robot shipments will decline in 2019. Although there are fluctuations in the short term, with continued automation trends and technological improvements, double-digit growth will be achieved from 2020 to 2022, with an average annual growth rate of 12% It will reach 584,000 units by 2022.

Detailed explanation of the five global robot markets

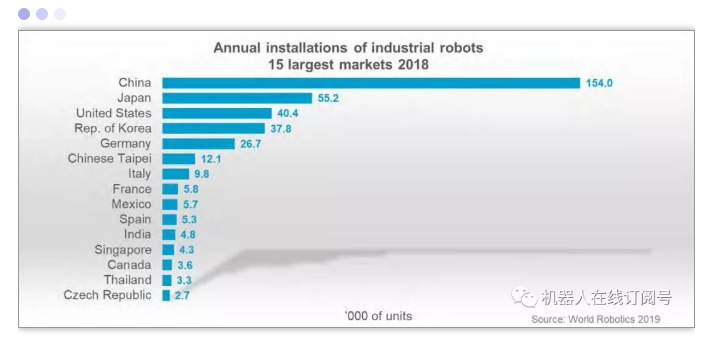

In 2018, the top five industrial robot markets accounted for 74% of global installations: they are China, Japan, South Korea, the United States, and Germany.

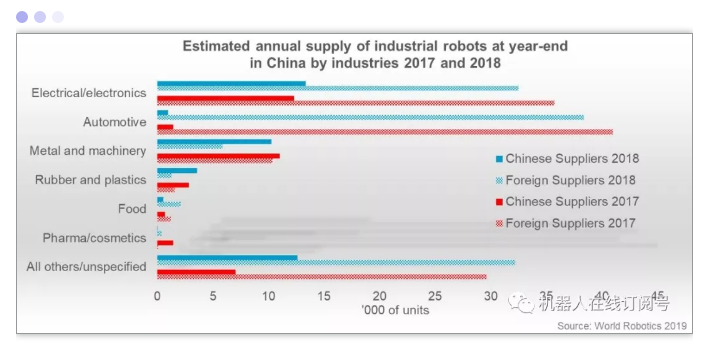

Competition in the Chinese robot market is fierce, and the future potential of independent brands is great

At present, China is still the world's largest industrial robot market, accounting for 36% of the total installed capacity. In 2018, about 154,000 units were installed. This is a 1% reduction from the previous year, but it exceeds the total number of robots installed in Europe and America.

In 2018, the installation of Chinese foreign-branded robots fell by 7% to 113,000 units in the weak automobile industry and unstable 3C industry (122,000 units in 2017).

What is gratifying is that the domestic robots performed well in 2018, and the total market installation share increased by 5 percentage points (27% in 2018 and 22% in 2017).

This data will undoubtedly give a strong dose of self-owned industrial robot enterprises in my country.

In 2018, the application industry of independent brand industrial robots continued to expand, involving 47 major categories of the national economy and 126 medium categories, of which electrical and electronic equipment and equipment manufacturing, and the automotive industry are its main application areas. The future growth of domestic robot companies The space will be bigger and bigger.

The highest ever, Japanese robot sales increased by 21%

In 2018, Japan's robot sales increased by 21% to about 55,000 units, the highest value in the country's history.

Since 2013, the average annual growth rate has been 17%. This data is particularly prominent for the already highly automated Japanese industrial production market.

We all know that Japan has the world's leading industrial robot manufacturers. In 2018, the supply of Japanese robot companies accounted for 52% of the global supply.

The number of robot installations in the United States has peaked for 8 consecutive years

The number of robots installed in the United States has reached a new peak for the eighth consecutive year. In 2018, the number of robots installed reached approximately 40,300. This is 22% higher than in 2017.

Since 2010, the driving force behind the growth of all manufacturing industries in the United States has been the trend of automated production to strengthen the US industry in the domestic and global markets.

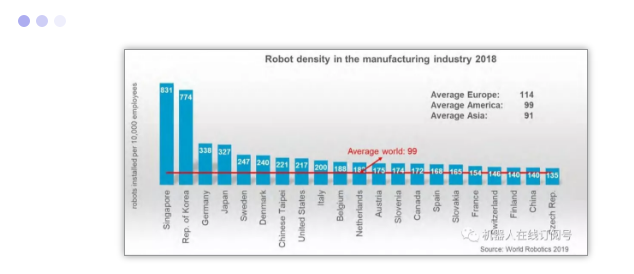

South Korea's installed capacity drops by 5%, and robot density ranks second

In 2018, robot installations in South Korea fell by 5%, and about 38,000 robots were sold. The reason is that its robot market has fallen sharply in the 3C electronics industry this year.

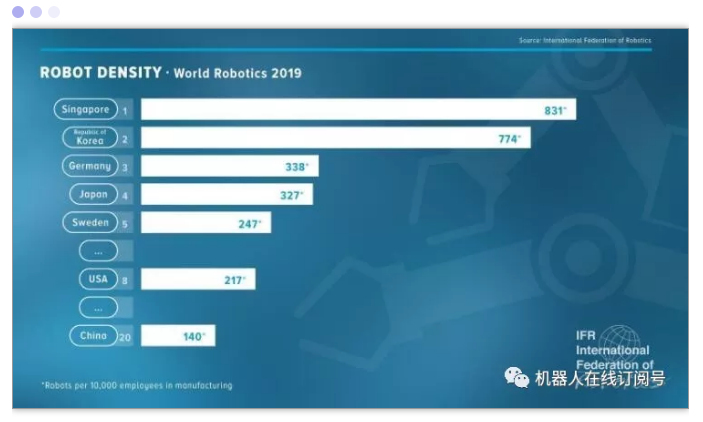

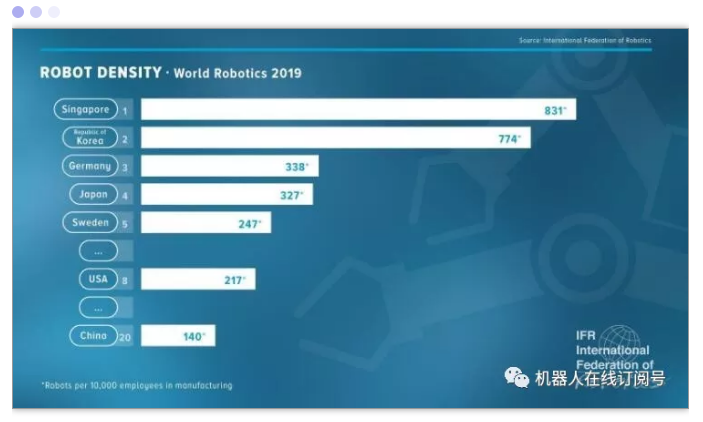

It is worth noting that in this year's global robot density ranking, South Korea, which has always ranked first, ranked second this year, and Singapore later ranked first, ranking the world's highest robot density country.

In 2018, China's industrial robot density reached 140, an increase of 34.3% compared with 2017, far exceeding the global average during the same period.

Germany, Europe's No.1, record sales volume

Germany is the fifth largest robot market in the world, ranking first in Europe, followed by Italy and France.

In 2018, the number of robots sold increased by 26% to nearly 27,000 units, a record of innovation. Its installation volume mainly comes from the automobile industry.

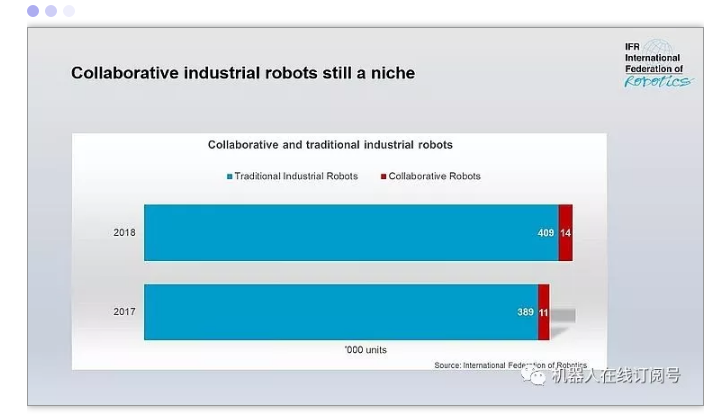

The potential of collaborative robots is highlighted? Whether it will become a new favorite in the future remains to be tested

World Robotics analyzed the market for collaborative robots (cobots) for the first time. Although cobots have attracted strong attention from major media this year, the number of installed units is still very low, accounting for only 3.24%.

In 2018, of the more than 422,000 industrial robots installed, less than 14,000 were cobots. In 2017, approximately 11,100 units were cobots. From 2017 to 2018, the growth rate of cobots (cobots) reached 23%.

Compared with traditional industrial robots, collaborative robots can be described as "in the wind and water" in the past two years.

Since UR launched the collaborative robot UR5 in 2008, the four major global industrial robots have launched their own collaborative robot products without exception. The collaborative robot "YuMi" launched by ABB, FANUC launched a large collaborative robot model CR-35iA, KUKA launched the collaborative robot named "LBR iiwa", and Yaskawa developed the "Dexter" Bot" collaborative robot.

This wave of "cobots" came to China in about 2015. In 2015, domestic manufacturers began to release collaborative robots. In 2017, new product releases increased significantly. Robot companies such as Alite, Aobo, Jieka, and Maga began to Layout in the field of collaborative robots.

Everyone has been competing in the field of collaborative robots this year. Under the downward trend of global industrial robot growth, collaborative robots still maintain a high growth rate, which shows that this field is indeed in the rising stage. For domestic robot companies, whether it means ushering in the best opportunity to break the foreign monopoly?

At the same time, it is worth noting that the collaborative compound robot has a high compound annual growth rate, but after all, its base is still relatively small. It will take time to test whether it can become a "new favorite" in the industrial automation industry in the future.

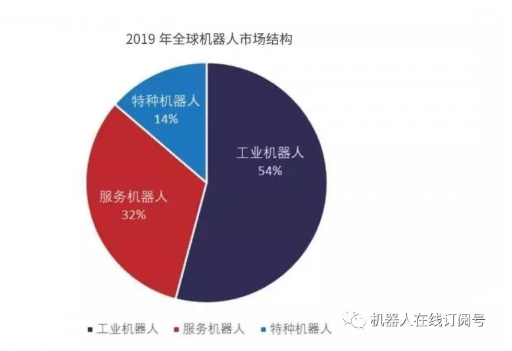

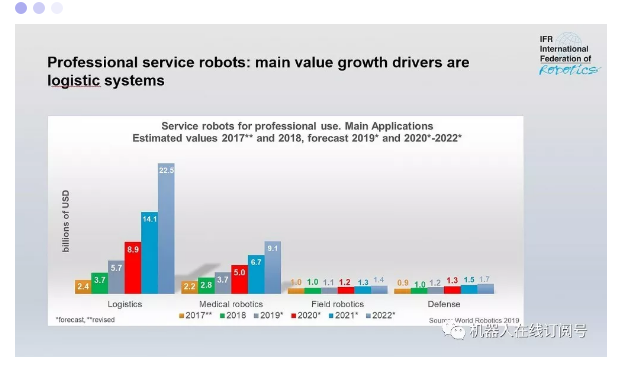

Service robot sales soared 61%, or become a new favorite in the future

According to the IFR World Robotics Report 2019, sales of service robots increased by 32% to US$9.2 billion. In 2018, sales increased by 61% to more than 271,000 units, far higher than 168,000 units in 2017, an increase of more than 10,000 units.

Unlike the rapid growth of collaborative robots but the small installation base, service robots have achieved both high growth rates and huge sales. Of course, this has a lot to do with many types of service robots and wide application fields.

According to the IFR World Robotics Report 2019, service robots' share of all robots' sales share is constantly rising, and is now close to one-third of the entire market.

In the field of service robots, the sales volume of logistics system service robots increased most significantly. In 2018, nearly 111,000 units were sold, which is 60% more than in 2017 (69,000). Others such as: inspection and maintenance robots (39%), medical robots (50% increase) have quite impressive results.

At present, the development momentum of service robots is strong. Both the growth rate and sales volume are considerable. Service robots are ushering in a golden period of development. As the trend of population aging is accelerating and the demand for medical and education continues to be strong, China's service robot has huge market potential and development space.